Last update August 1, 2023

Overview

Starting from July 1st, 2021, three main changes will kick in regarding VAT on online sales into and across the European Union:

- A single EU-wide distance selling VAT registration threshold of EUR 10,000 will apply and replace the former country-specific VAT-collecting thresholds.

- The responsibility for collecting VAT on online purchases performed inside the EU by Extra-EU sellers, shifts from sellers to marketplaces for small-value parcels (below or equal to Euro 150).

- All imports will be subject to EU VAT tax. Previously, goods shipped to EU buyers were VAT-exempt if valued at Euro 22 or less.

Such restructuring impacts all operators in the e-commerce value chain. Let’s see how, and point to useful resources. We will also see how marketplaces and e-commerce platforms implemented these changes and how Nembol can help you.

These changes apply to all online sellers doing business in the EU, hence including UK sellers, North American sellers, and sellers shipping to the EU from all other regions. Nembol is no tax adviser: you are responsible to consult with local tax authorities or a tax professional.

Resources

The single best true truth is the EU shining new VAT for e-commerce Web pages.

The page dedicated by eBay to EU VAT obligations for international sellers is also a valid resource.

Let’s start from the basics: what is VAT?

What does VAT mean?

VAT stands for Value Added Tax, and all European citizens are familiar with it from their birth. it is similar to the Sales Tax of which North Americans have experience, with one main difference:

- Consumers throughout Europe are used to see a retail price INCLUSIVE of tax, while

- Consumers in the US are used to see a retail price NET of tax.

How does VAT work?

Besides this, Sales Tax and VAT are both:

- Similarly expressed as a % on the net price;

- Collected by sellers which have the obligation to pay it to the tax offices.

For a software system, such as a marketplace or an e-commerce back-end, the main difference is in the price that by default a seller tends to express:

In Europe, a seller thinks and talks about the GROSS PRICE, and hence typically types in the price field the price INCLUSIVE of VAT

In America, a seller thinks and talks about the NET PRICE, and hence typically types the price EXCLUSIVE of Sales Tax

The latter creates quite an issue when it comes to trim these systems to sell across countries that have some a Sales Tax and others a Value Added Tax (VAT).

Facts about European VAT

How is VAT calculated?

- VAT is calculated according to destination, i.e. tax is applied to a customer based on their location;

- In the EU, VAT rates differ from country to country;

- VAT rates are also different on different types of products and services, ranging in some counties from 0% to rates over 20%;

- Such different tax rates are different across countries and are used by the national tax authority to protect some sectors or to incentivize some specific consumptions.

Who collects the VAT?

In the EU, typically listed prices already INCLUDE VAT;

Because VAT is included in the paid price, it is collected by the seller.

How does the VAT work, in practice?

- Sellers throughout the EU are required to register for a VAT ID to be able to collect and pay Value Added tax. Such VAT i.d. is provided to you, seller, by a member country’s tax authority when you register with them.

- In case of an international sale, say for example from a Polish seller to a Spanish buyer, we are witnessing a net transfer of money from the Spanish citizen buying the good to the Polish tax-man, via the Polish seller which gets taxed at home. The same applies when the selling partner is established in an Extra-EU country.

- For the latter reason, each EU country historically set a threshold in value of imported goods or services, above which a seller is obliged to register for VAT-purpose in that country, and then collect and pay VAT in that country. This is true for all European countries. Starting July 1st, 2021, this threshold is unified across all Europe and brought to Euro 10,000 of total merchandise value sold in European countries in addition to a seller’s home country.

Example from the point of view of the tax authority of some European country: if you are a small importer to my country, I don’t worry about you: I accept you take VAT money from my citizens and pay it to your home tax office. But if you are a large importer, well, the value you are extracting is too large for my country to accept it. So please, register your company with my national VAT office, apply my VAT rates, and pay the collected VAT to me.

What does the EUR 10,000 threshold mean?

Up to June 30th, 2021, each EU country would set its own import threshold above which a seller was obliged to register in that country for VAT purposes. Such different thresholds would range from Eur 35,000 to 100,000 depending on the country.

From July 1st, 2021 onwards, these thresholds are abolished and substituted by a unique EU-wide threshold of Eur 10,000. Using the European Commission’s own words: “If your sales are above this threshold, you are liable for VAT in the Member State where your buyers are located“.

Each seller will though be able to enroll in EU’s VAT One Stop Shop where they can declare and pay VAT owed in other member states.

If your combined sales to all EU member states other than the one where you are located are less than Euro 10,000, then you can change your home country’s VAT rate on all your EU shipments and remit VAT to your home country’s tax authority.

I am an online seller. Am I impacted by changes after July 1st, 2021?

If you are selling online and the combined total of your sales across the total of the EU countries exceeds EUR 10,000, after July 1st you are obligated to collect VAT in each EU country based on the delivery address of each of your shipments.

Marketplaces are now obligated to collect VAT for shipments from extra-EU sellers to non-VAT-registered sellers. Being such responsibility now on the marketplaces on behalf of extra-EU sellers (beware the UK is now outside the EU), they will implement it according to their seller policy (see below).

European sellers will need to register for the One Stop Shop, and are required to comply with VAT rules independently from the marketplace or marketplaces they use.

How do marketplaces and e-commerce platforms manage this change?

VAT on Etsy

Being a marketplace, Etsy is responsible to collect VAT on EU deliveries of extra-EU sellers. Etsy’s support articles are also well made for VAT obligations of EU-based sellers.

The main points are:

- If your intra-EU sales exceed Eur 10,000, you are suggested to register with EU One Stop Shop.

- If you do so, you may enter your One-Stop-Shop VAT ID in your Etsy account settings under: shop manager > finances > tax I.D.

- Starting from July 1st, Etsy will collect VAT on physical goods sold to EU buyers that are imported into the EU where the value of the imported physical goods is less than or equal to Eur 150.

- As soon as you near the threshold, Etsy will warn you via email and require that you add your taxpayer name and VAT ID to your Etsy shop in order to continue selling on Etsy.

- In order to avoid your customers from being charged VAT twice, you must share Etsy’s IOSS number (which can be found under Orders & Shipping in Shop Manager), directly with your shipping carrier, and you must not use it for any other purpose.

- It is currently unclear whether Etsy will simply add the VAT to the published retail price of a seller. This is very American, but European buyers would be very surprised. In Etsy Staff’s own words: “.. since EU buyers might pay more for your items, … make any necessary adjustments ahead of time!“

- In fact, eBay (see below) implemented a VAT-rate field and will consider all published prices as VAT-gross. We are unaware of such field and calculations in Etsy, please let us know in case you had further information. We will provide at updating this article as needed.

eBay EU VAT

If you are an extra-EU seller shipping to the EU, you now have to declare to eBay the VAT rate of your products. You still have to declare the Gross price in the price field. Which is correct, as understood by any EU customer.

In addition:

- Also when it’ll be eBay collecting VAT on international shipments on your behalf, your buyers will not be overcharged as VAT will be extracted from the final price your customers saw in your listings, not added to it risking refusals and returns.

- You must display your VAT identification number in connection with your listings. You can do this by updating your business seller information on eBay.

- Of course, if eBay determines or receives official information that a seller is not meeting their VAT obligations, or they provided incorrect information, a seller’s account may be blocked from selling and listings removed.

- Sellers should ensure that their account is up to date, with correct registered addresses, VAT ID, and correct locations from which orders are shipped.

Shopify EU VAT

Shopify as usual provides very well-written and complete tutorials.

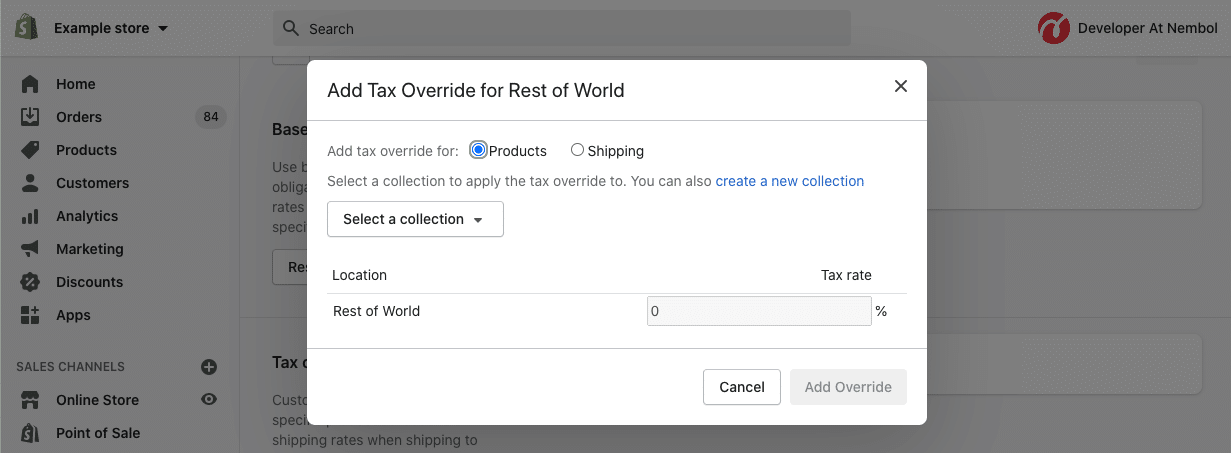

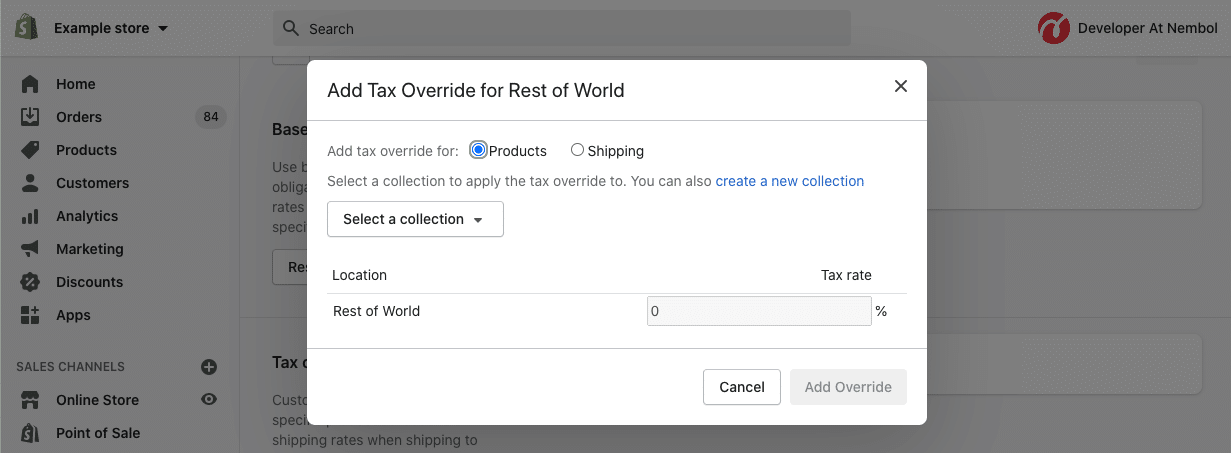

Shopify mechanics for sellers are as follows (again: both Nembol and Shopify remind this is not a tax advisory article and that you should consult with your country’s tax authority or a with an international tax advisor). Shopify sellers should:

- Activate Location-based taxation in Settings > Taxes

- Include taxes in their product prices. I.e. consider prices as GROSS, as eBay suggests

- Define base taxation, which can be your default home taxation.

- Create a series of regions for tax-purposes

- Create a series of collections for tax purposes (remember that different product types may have specific VAT rates)

- Create tax overrides to your base taxation in which you assign a given tax to the intersection of a region and one or more collections. See screenshot below

Shopify is not a marketplace, therefore all Shopify sellers are required to comply with EU VAT requirements directly. The suggested way is to enroll in a One-Stop-Shop.

What happens to the prices of my products?

Most likely, you will not want to change the prices of your products published in your listings, then:

If you import into Europe

VAT has always been charged to your parcels at the entry point, you may have had a policy of taking this tax on you, normally this was done through the courier, or otherwise, you let your customer pay for it. So now there isn’t a big difference:

- If you sell through eBay and add the VAT rate to your listings, the total price paid by your customers won’t change and VAT will be deducted from your income. Make your calculations on your margins!

- If you sell through other marketplaces, or ship directly and use a courier, VAT will be added on top of the listed retail price. Which is the same as what used to happen before.

If you are based in Europe and sell into other European countries

If you sell across Europe more than Euro 10,000, Since you’ll pay VAT locally, your margins will vary by some % points depending on the country in which you ship.

If you sell across Europe less than Euro 10,000, nothing will change.

How does Nembol help?

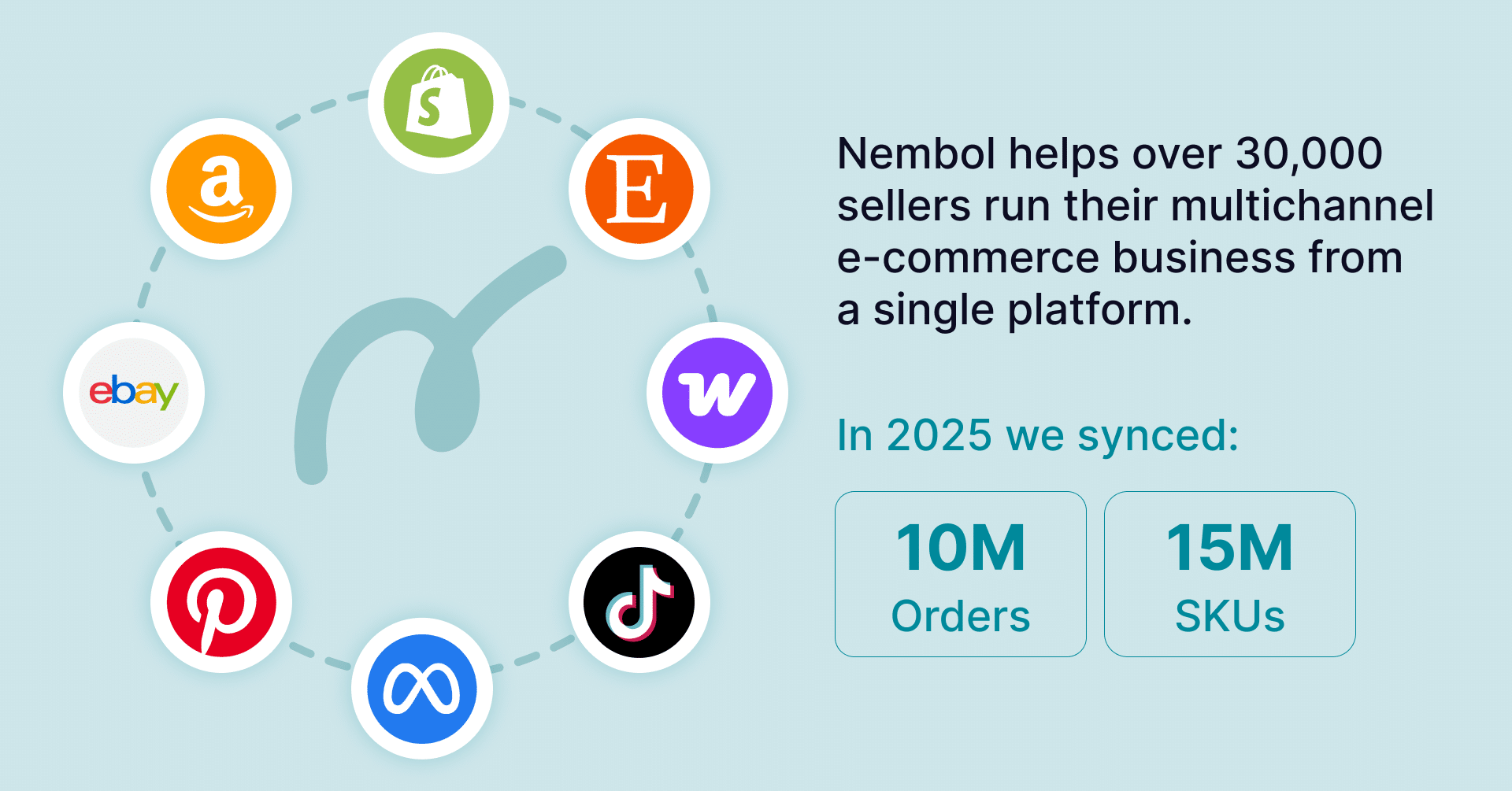

Besides providing support and guides, like the current one:

- Nembol is adding a VAT-rate field in its product card and in some channels’ settings. This will allow sellers to declare the VAT rate of each of their products (VAT may differ from a product to another). As we’ve seen, an indication of a VAT rate is required by marketplaces from non-EU sellers selling to consumers.

- Such VAT-rate field will magically correct all your existing listings when a marketplace (e.g. eBay) accepts such information

- Nembol released in early June the Export-Import CSV function enabling quick and exact edits via spreadsheet to your whole product catalog. Nembol users can hence download their products, change the prices if so needed, upload them again.

In addition, we’ll keep an eye on the future evolution of the VAT ruling across Europe, update our tutorials, and warn all sellers registered to our services and Newsletter.

As usual, don’t hesitate to comment in the box below or in the in-app chat.

Have a great rest of the day.